Funding a Degree in 2025 is harder than it should be

The average student's monthly shortfall is raising concerns around the survivability of being a student in 2025

Discourse around being a student in 2025 is multiplying since the government’s decision to increase tuition fees from £9,250 to £9,535 from 2026 onwards, causing people to question if maintenance loans will also increase, as inflation rises.

“Too many students are facing financial hardship”, reflected Skills Minister Jacqui Smith and urged that the government recognise something must be put in place. The Independent reported that “student’s are facing a never-ending cost-of-living crisis” in 2025, as maintenance loans are falling significantly short of rising costs, leaving us to wonder if this is something students should be battling while trying to obtain a degree. Will this push students to work more and study less? If so, for some students, what would be the point of advancing on to higher education after A-levels?

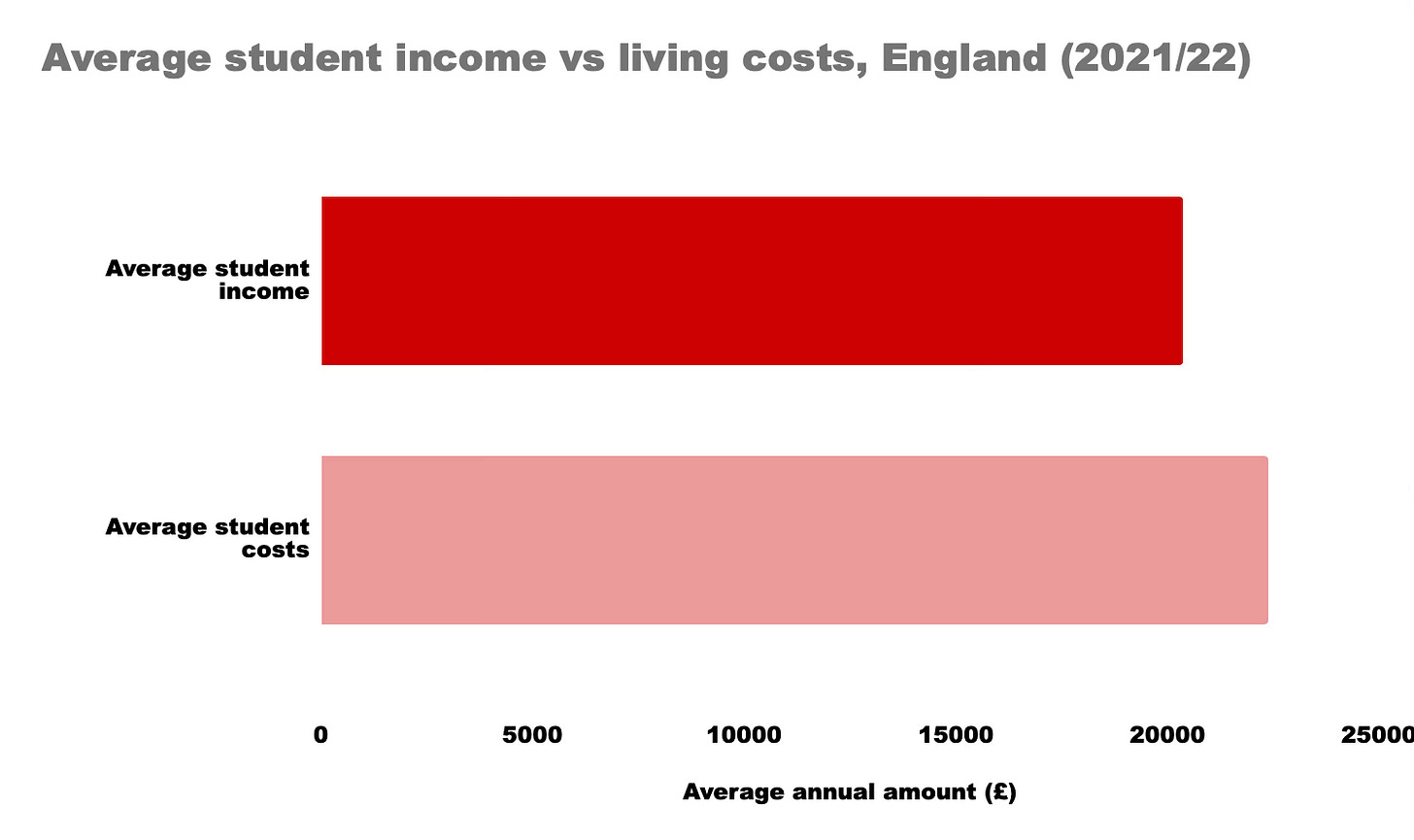

The most recent data released by the government showing statistics of student income versus student expenditure was in 2023, showing figures from the years 2021/22. The data below was sourced from the UK Government’s Student Expenditure and Income Survey for 2021/22.

In 2021/22, the average full-time student’s annual shortfall in England was just over £2000, around £200 per month, this was after all types of other income was considered, such as money from a part-time job or help from parents. Funding a degree is becoming harder and harder for students and families, especially in areas with higher living costs.

Comparing these figures to Save The Student’s annual survey for 2024/25, which reported an average shortfall of £500 per month. The UK Government is failing to tie maintenance loans to rising living costs, it’s clear that loans need to catch up to inflation. And students in Oxford are asking, where is their funding?

“The stress of worrying if rent can be paid next month, or if my weekly food shop can be done is too much on top of the pressure of studying. I’m having to work near full-time hours to ensure I can even survive at university”, said Ellie, 20, a Business student at Oxford Brookes University, “It’s frustrating that there doesn’t seem to be much consideration for students who have no other significant source of income while receiving a loan which doesn’t cover all of their costs.”

Save The Student reported that 76% of students worry about being able to make ends meet, with 83% saying their money struggles impacted other aspects of their wellbeing.

“The National Student Money Survey, which has been run since 2013 by Save The Student, found nearly three in five students (59%) reported skipping meals at least some of the time to save money”, The Independent reported.

Being a student, the concern around what it takes financially to get a degree is one which is growing faster than ever, and the conversation around funding needs to be louder. Going into higher education used to be a step worth taking, and one which we felt encouraged to by our government. Now, grants are disappearing and student poverty is ripe, with more than two in five students dropping out of university due to money worries. Even if a student is in receipt of a maximum maintenance loan, they need to work 20 hours a week throughout the year to hit the Minimum income standard- and remember, this is while being on a full-time, higher education course.

Experts are saying that the cost-of-living pressures are changing the university experience, with students not getting the full benefits from institutions. When our policymakers were in higher education the student experience was much different to what is it today, it’s being called for universities to consider offering more support for students who balance more commitments than just their studies.

And the universities are listening.

Universities UK said support has been stepped up, “by providing additional targeted hardship funding, digital technology so they can continue to learn flexibly, increased wellbeing and mental health support, access to discounted meals and other helpful initiatives.”

Whether maintenance loans can rise alongside inflation rates is something Education Secretary Bridget Phillipson is addressing, as she announced last year that “maximum maintenance loan will rise by 3.1% in line with inflation to help students cope with costs”.

Nevertheless, students around the UK are still wondering if they can make it through the month. The difference in income vs expenditure is worrying. It’s imperative that our government put longstanding resolutions in place to close the shortfall students are succumb to each month.

The £500 monthly shortfall stat is brutal. That's effectively forcing students into near full-time work while in full-time education, which defeats the entire purpose of having maintanence loans. I remember scraping by on £200/month when I was studying and that was tough enough, but the gap has tripled since then. This is going to push more people away from higher ed entirely.