“It’s just ludicrous”: The area of Oxford where residents can’t afford to buy property

Census data shows a decrease in people owning their properties as prices rise and wages fail to keep up

Throughout Oxford, specifically in Littlemore and Rose Hill, more residents are struggling to buy their properties now compared to 2011.

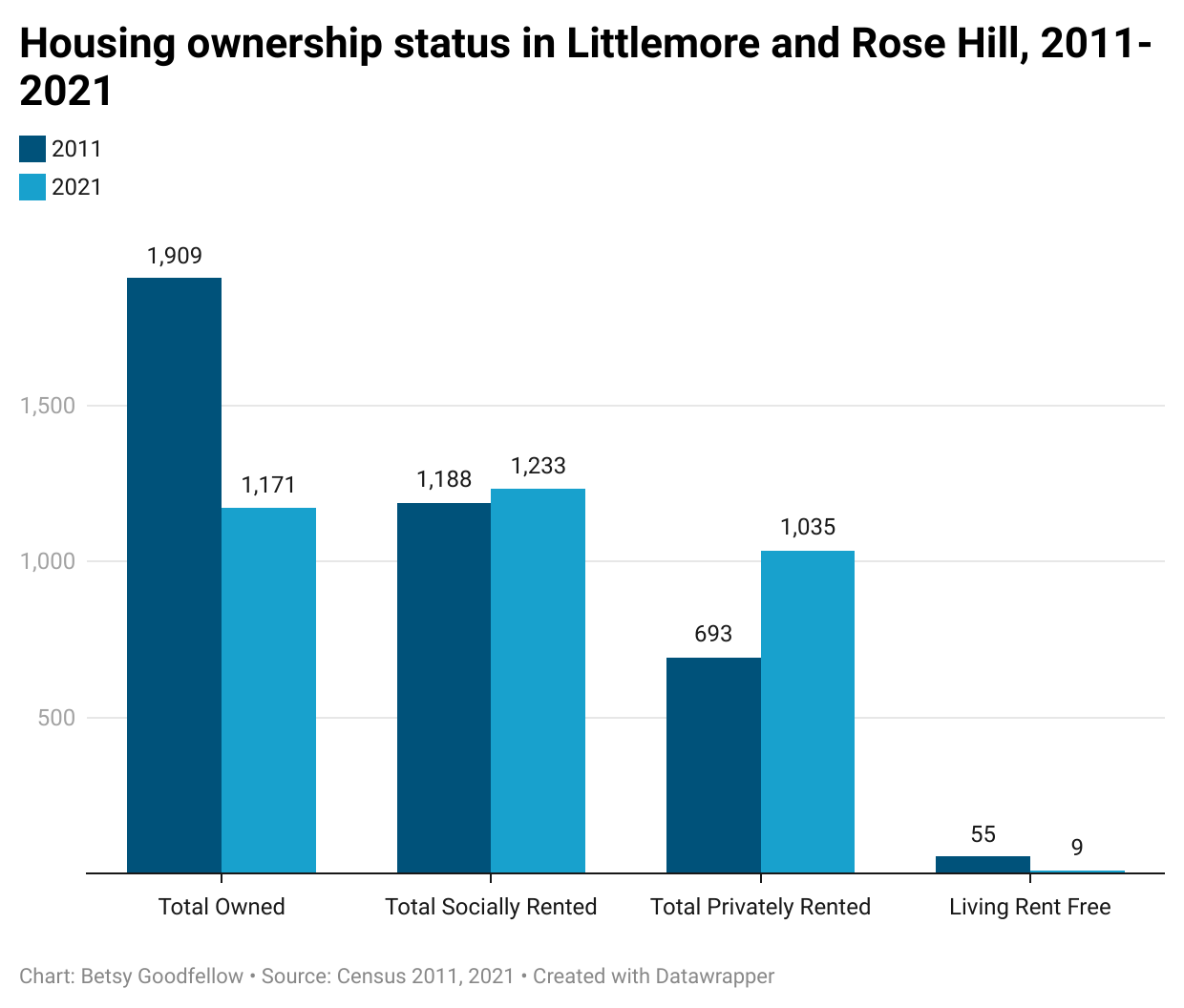

Data from the two most recent censuses shows a 3% decrease in households owned by their inhabitants, whether outright or with a loan or mortgage, in the whole of Oxford in the ten years between 2011 and 2021, and a 39% decrease specifically in Littlemore and Rose Hill. Conversely, Oxford Central – which covers most of the city’s centre – saw a slight increase (approximately 2%) in owned properties.

Hamza Qaisar Abbasi, 33, who moved to Littlemore a few weeks ago and currently rents his property, believed that compared to other areas “the Oxford housing market is quite expensive. I think more specifically for first time buyers, they find it really hard, first to find [a property] and then to fund it.”

Notably, in all three areas the percentage of properties owned outright has increased between 4-6%, suggesting that a somewhat significant proportion of homeowners were able to pay off their mortgages in the ten years between the censuses. However, houses owned with mortgages and loans decreased across the board (approximately 5-16%), implying that fewer people were able to join the property ladder across the board in Oxford by 2021.

Rosemary and Leslie Williamson, both 74, bought their home in Littlemore over 20 years ago – they shed some light on issues of housing around their neighbourhood, explaining that the biggest barrier for first time buyers is “the deposit system, because that's hard. By the time you save, save, save, the prices are going up, so perhaps the threshold for that needs a bit of work.”

Rosemary continued, gesturing to new builds around the area: “We've recently had a whole new development of just over 300 properties, and they're affordable, shared ownership. And there's several little pockets of land where they're just building half a dozen houses. There's new builds at the back of the pub that they've just done, and down quite a few of these roads, so [the housing market is] not too bad [in Littlemore].”

Interestingly though, shared ownership in Littlemore decreased by 20% between 2011 and 2021, however it is highly possible that the new estates around the area have sprung up in the four years since the last census meaning the shared ownership statistics do not accurately reflect the area as it is today.

Social renting also increased in Littlemore and Rose Hill, up by around 6% between 2011 and 2021, although with the cost of living crisis hitting its peak since 2021 it’s likely that this figure is even higher now than the census suggests.

Lyndsey Marie Seale, 44, who has rented her house in Rose Hill from the council for the last 11 years, stated that the housing market in Oxford is “really, really, really ludicrous, and so expensive – if I were to move to a private landlord property, I couldn’t afford to live because it’s just so expensive. So I'm lucky I'm in a council house. I think it's just ludicrous, the rents are too expensive in this area for people to get on [the housing ladder], and the mortgages – youngsters have got no chance to buy their houses in Oxford.”

Similarly, the private rental market saw increases in most areas, with the wider city seeing an increase of 14% and Littlemore and Rose Hill’s privately rented households growing by a huge 49%, perhaps because very few of those who move to the area can afford to buy straight away.

One potential explanation for this lies in the rising house prices throughout the city. Centre for Cities data demonstrates an enormous 56% increase in the average house price in Oxford between 2011 and 2021 (£357,360 to £558,406). Prices continue to rise, as last year, the average house price in Oxford was reported as £571,315, placing the city as second only to London in terms of housing prices.

Additionally, in the same ten years, average wages in Oxford increased by a miniscule 2% (from an average weekly earning of £746 to £763.70), and another 2% to 2024 (£777), which may also explain the decreasing levels of house ownership in the area.