The Minimum: Has Raising The Wage Helped Students Survive?

The UK Government raised the minimum wage a month ago, but has this increase in cash helped the university student with surviving the cost of living crisis?

Just over a month ago, on the 1st of April, the minimum wage was raised by the UK government in response to the cost of living crisis.

This crisis, which has been in action since 2021, has raised the financial stakes across the board for UK households, and students are certainly not immune.

At Oxford Brookes, the recommended hours for a student to work alongside their studies is just 15 hours, so the question should be posed: with the new rise in minimum wage, is it possible for students to survive on those 15 hours a week, and, more importantly, is survival sustainable?

The Raise in Wage

The government’s new minimum wage has raised pay checks across the UK. For those aged 18-20, this new wage per hour has been upped by £1.11 to £8.60 an hour, whilst those aged 21 and above have been given a £1.26 bump in pay, to a grand total of £11.44 an hour.

Although this raise in pay will inevitably assist the finances of many people, how does this change in wage affect the student?

Through cross referencing multiple oxford-based estate agents and their student home listings, we can see that the average rent for a student per week comes out to £164, with the highs and lows for weekly rent coming in between £92 and £392.

Looking at this average, we can see that the self-sufficient student would have to work at least 19 hours a week if they were under the age of 21, and just over 14 hours if they were 21+. Now, these statistics more or less stand by the recommended 15 hours of work per week, but what about other bills? The more you look into the financial burdens placed upon students, the more dire this situation seems to be. Let’s create a hypothetical student, and see what they’ll be expected to work to support themselves with this new minimum wage.

Our hypothetical student.

Let’s meet our hypothetical Oxford Brookes student. This is Sam.

They are a student at Oxford Brookes University and they work to support themselves at university.

They applied for a student loan, and received £2,312.50 in maintenance for their first five months at university (September-January).

Their maintenance loan lasted them around two months, so now, for the remaining three months of the term, they have to support themselves entirely.

Sam is relatively thrifty, and they try to spend the bare minimum - so let’s have a look at their finances.

Sam spends:

£130.38 per week on living (food, personal items, social activities etc.)

£14.32 per week on necessary bills (electricity, water, heating, wifi, TV license)

£164 per week on rent

Therefore, Sam is spending £309.12 per week.

Let’s say for arguments sake that our hypothetical student, Sam, is 19 years of age. Sam is going to need to work 35.9 hours per week to keep up with the bills - that is effectively one hour more than what is considered ‘full time’ work, and it is certainly far away form their universities recommend hours of 15 per week.

Jumping from the hypothetical.

Moving away from the hardworking hypothetical Sam, it’s time to look at some real testimonies from 40 current students at Oxford Brookes University.

In a survey, it was revealed that 77.5% of responding students work alongside their studies at Brookes, with 93.5% working for an hourly salary.

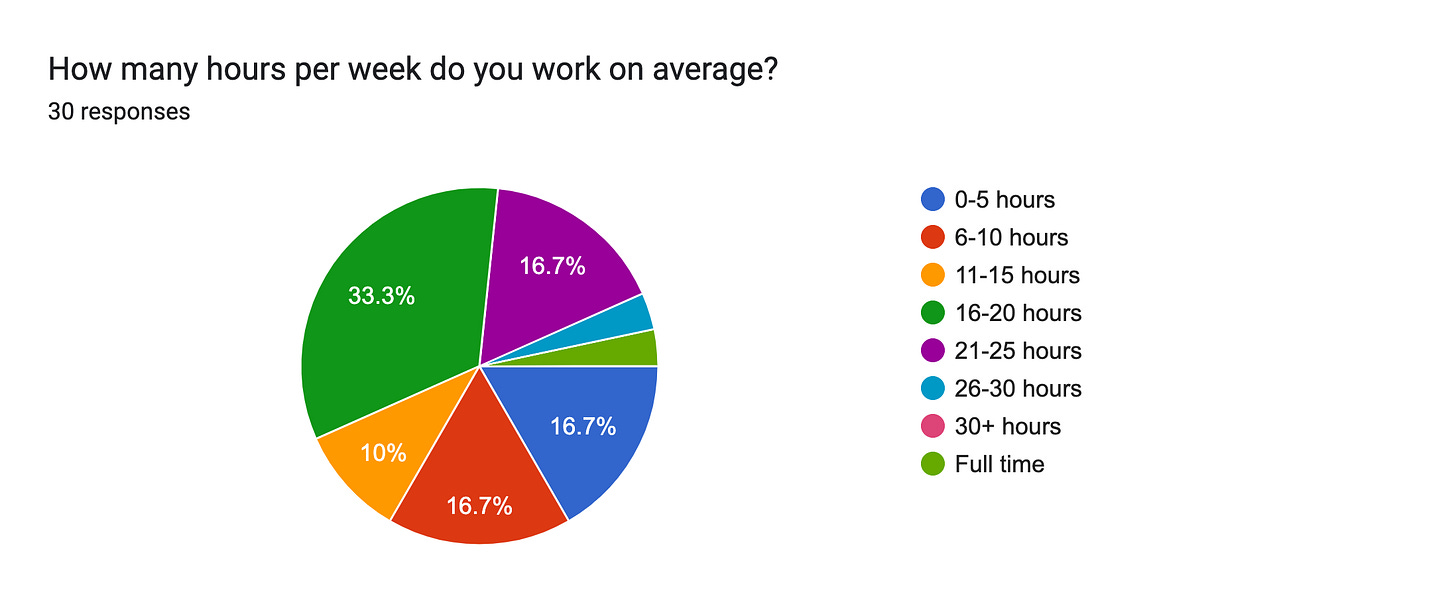

Of this percentage, the survey revealed that 56.6% of these working students worked over the universities recommended hours, with 33.3% working 16-20 hours, 16.7% working 21-25 hours, and 3.3% working a 26-30 hour week.

In addition to this, of the responders, 45% indicated that their earned wage was their main source of income, whilst 27.3% rely primarily on their student loan, and 27.3% cite that ‘other financial assistance is provided’.

I spoke to one of these students, Lily, aged 23, to get a better look into a student’s day-to-day experience with working whilst at uni.

Lily, who works roughly 12 hours a week, said that ‘something always slips’ when working alongside university. ‘There’ll be too much uni work to do, so I’m not making money, going to the gym, meeting friends… it’s hard to prioritise.’

When asked about the universities hourly recommendation, Lily said that ‘ideally you would want to work more than 15 hours, but whilst being conscious of the importance of uni work - it’s definitely a cause of stress!’

So, does the raise in wage help?

Realistically, no. With the pressure that students are under from university, work and a social life, this raise in wage is only a slight buffer to the financial pressures many students struggle with.

Part of this issue, of course, is the price of Oxford’s housing - Oxford ranked #4 in the UK wide ranking of the top 15 most expensive places to live. The other element of note here, besides the obvious crisis, it the Oxford-based university experience itself - a pint that costs over £5 in most locations is almost eye-watering - and these problems, combined with the cost of living crisis, constantly persist for the working student in Oxford.

What defines the ‘student lifestyle’ at the current moment - for many students - is living hand to mouth with the looming threat of missing out hanging around the corner.

Thankfully, this bleak outlook is not entirely accurate. There are highlights to this cost of living conundrum. For example, what quicker way is there to learn to budget and live within you means other than practicing it religiously? The cost of living has not made it easy for students to be self sufficient, but learning that balance is a crucial skill that many of us will have picked up along the way.

And that extra £1 and a bit - that will take a little of the tension off, surely?